Self-Managed Buildings: Tips for Brokers, Bankers, and Clients from a New York Real Estate Lawyer

Self-management helps smaller buildings save on the expense of retaining a management company. In exchange, unit owners (or the shareholders of a coop) take on the responsibility of performing building related tasks. These can range from repair and maintenance work to accounting and record keeping services. While self-management can help buildings balance their budgets, self-managed buildings also pose unique challenges to New York City brokers and real estate attorneys.

We’ve identified some common pitfalls, along with tips on how to navigate them.

1. The building may not have a point person to answer diligence: Identify one early to be available throughout the transaction. Bonus if they use (and are responsive by) email.

The Purchaser’s real estate attorney, and any lending institution involved, will need diligence questionnaire(s) completed. Find a person on the inside early on that can properly answer questions, and line up a backup contact in the event of work conflicts, holidays, or vacations.

2. Board minutes are scattered or unavailable and Financials are not audited: Ask Seller’s side to make sure the minutes are compiled, along with at least 2 years’ financials for review.

Self-managed buildings may only have unaudited financials or excel balance sheets with no accountant opinion at all. In those instances, real estate lawyers and brokers must carefully guide the process through the buyer’s bank to avoid an unnecessary underwriter denial.

Brokers and real estate attorneys can further recommend an experienced, responsive banker for the specific type of transaction (condos/coops/new construction/resale). This is especially helpful when expecting diligence to be returned in unorthodox formats.

3. Building is not pre-approved by major lenders: Brokers can check which lenders have closed in the building; bankers can be advised to start their diligence process as soon as possible.

Building approval tends to be easier if the lender has already approved a loan in the building. If the lender is not familiar with the building, the banker should try to submit their questionnaire as soon as possible to help determine if the bank will lend in the building. Brokers and real estate lawyers who forget this step can find themselves in a situation where the buyer is initially approved but the bank raises a last-minute issue preventing the loan from closing (e.g., insufficient reserve funds or inadequate insurance).

4. Building Lacks Common Form Documents: Brokers can confirm that the building has commonly needed items: master certificates of insurance, a standard purchase application (or a set purchase process), waiver letter with common charge letter (condos), or a coop attorney or coop closing agent ready to coordinate closing.

Self-managed buildings often lack a set of commonly used form documents, and this is especially true if transactions infrequently occur. During one of our recent transactions, a building did not answer the bank’s repeated requests for the building’s proof of insurance. Following up and pushing for answers did not help because the building’s contact didn’t know what the banker was requesting. We helped the building secure an insurance broker and obtain adequate insurance to get the transaction closed.

There is no exhaustive checklist for this problem, but it’s important to have the right mindset: everyone is a team player getting the parties to close. Sometimes this means going above and beyond your job description.

Armed with the tips above, brokers, bankers, buyers, and lawyers can help the process move smoothly from due diligence to closing. Remember that the point person for a self-managed building is ultimately a busy New Yorker volunteering their time to help manage the building. Empathy, along with your own arsenal of sample documents, can go a long way – hopefully, all the way to a successful closing!

The Mortgage Contingency Clause

By Jack Harari

Sellers and Buyers alike often inquire as to the meaning of the “mortgage contingency clause,” one of the more significant clauses in New York real estate contracts. Simply put, a mortgage contingency clause ensures that if a buyer promptly applies for a loan from a qualified lender, but fails to obtain a firm commitment for financing within the specified time period, then the buyer may elect to cancel the contract and receive the return of the initial downpayment. It should be noted that the commitment letter should not be confused with the “pre-approval letter.” A pre-approval letter is typically a nonbinding letter of very little legal weight issued by a bank prior to conducting a more detailed investigation of the borrower and the property.

There is often a great deal of confusion in the New York real estate market as to whether a mortgage contingency clause is “necessary.” The common explanation given is that buyers should request the clause because it affords them added protection if they are applying for financing, while sellers should avoid the clause because it may result in delays caused by the buyer’s loan approval process, or by having to find a new buyer altogether in the event that the buyer in contract cancels under this clause.

Whether a mortgage contingency clause is “necessary” depends on several factors, including: (1) the financial status of the buyer; (2) the appraised value of the unit for sale; (3) in the case of co-ops and condominiums, the financial viability of the co-op or condominium community of which the unit is a part; (4) overall real estate market conditions (e.g., buyer’s market, seller’s market, lender’s market). For example, a relatively wealthy individual buying a co-op unit that appraises below the contract price and in which the bank’s underwriters are not satisfied with the financial condition of the co-op may be denied a loan, where a person with relatively less wealth buying a condo that appraises exceptionally high in a financially solid building might be approved. And in either case, the overall real estate market conditions may result in a very different reality. For example, in a “seller’s market,” a seller who has prospective buyers banging down the door with offers well above asking price will have little incentive to agree to a mortgage contingency, while in a “buyer’s market,” the same seller might have no other option but to include the contingency or lose a potential buyer.

It should also be noted that there is no “standard” mortgage contingency clause in New York, although there are a number of common clauses circulating through the industry. Some clauses act like protective bubbles that surround the buyer for a time, and then “pop” and disappear altogether once certain conditions are met. Other clauses act more like shields that guard the buyer from certain conditions throughout the entire contract process. It may be possible to find a middle ground that can satisfy the buyer’s need for financial protection, while reassuring the seller that the contingency period will be short. Therefore, we strongly urge prospective buyers and sellers to consult with their attorneys about this clause in particular, and about the overall process of negotiating a deal from the time of offer/acceptance, to signing the contract, to closing!

A Purchaser’s Guide to NYC Real Estate: What Is an Offering Plan?

For clients buying into a Condominium or Cooperative, often their broker or attorney will provide them with a massive tome called the “Offering Plan.”

When faced with approx. 500 pages of potential homework, clients often ask: what is this, why is it important, and do I really need to read the whole thing?

Here’s what you need to know:

What is it?

The Offering Plan is presented to the initial buyers purchasing directly from the Sponsor/Developer. It represents what the Sponsor committed to constructing prior to the building being built or converted to a condominium or cooperative. The Offering Plan is then passed from seller to buyer like an heirloom tied to the unit.

Why is it important?

If buying a new construction unit, the Offering Plan (with any amendments) may be your sole source of diligence. If the building is not yet constructed, it will tell you what you are putting your money towards. Sponsors will need to deliver a unit in accordance with both the Offering Plan and the Purchase Agreement.

For resale transactions, the information becomes increasingly dated and may no longer be relevant. These buyers should be careful not to rely solely on the initial Offering Plan with respect to their individual unit or the overall condition of the building, but all unit owners still need to keep the Offering Plan in a safe place to pass on to their future buyers.

What should I focus on if reading the Offering Plan?

Diligence is conducted until a purchaser is happy and comfortable proceeding, so the level to delve into any of these documents is self-determined. For buyers hoping to personally review the Offering Plan, finding the table of contents or index in the first few pages is crucial for helping locate the following key sections:

- “Schedule A” – this is a snapshot of the building showing a list of units at the time of the offering, original percentage of common interest/shares, the original purchase price, number of rooms, projected common charges/maintenance, and initial treatment of any storage, parking spots, terraces – to the extent these exist in the building.

- “Special Risks” – this section expands on the additional risks associated with the project. Cautious buyers may review this section for things ranging from how to care for the wooden flooring and limited warranties for the unit and/or building to the existence of lot line windows (windows that may need to be boarded up in the future).

- “Floor Plans” – floor plans are rare finds in the offering plans of cooperatives and older buildings. When found, they are helpful to compare against the current configuration of the unit for any alterations to the unit that may have been done by the current or prior owner.

- “Description of Property” and any Architects Report – these sections may contain projected structural information about the building, materials used, appliances installed, building amenities, and systems. Sometimes this can be helpful identifying materials used in the past that are no longer acceptable in the present (e.g., asbestos and lead paint).

- “By-Laws” and other governance documents – initial by-laws, documents for board governance, and initial ownership documents are typically towards the back of the Offering Plan. For purchasers into a cooperative, a copy of the Proprietary Lease is generally included with the original house rules.

Lastly, please note that the Offering Plan may have been continually amended by the Sponsor/Developer, so it’s important to check that the information you are reviewing has not been overridden by a later amendment.

Of course, you should always let your attorney know if any questions!

NYC Real Estate Attorney’s Closing Report: July 2018

Just a few of our recent closings. If you are also looking to buy or sell at these property addresses, you might want to give us a call.

| Property | Value | Transaction |

| 415 Grand Street, NY, NY | $785,000 | Coop Purchase |

| 300 East 85th Street, NY, NY | $1,250,000 | Coop Sale |

| 264 Lexington Avenue, NY, NY | $915,000 | Coop Purchase |

| 66 Overlook Terrace, NY, NY | $639,000 | Coop Purchase |

| 250 East 87th Street, NY, NY | $1,785,000 | Coop Purchase |

| 420 East 58th Street, NY, NY | $640,000 | Condo Purchase |

| 16 Tremper Avenue, Phoenicia, NY | $297,500 | House Purchase |

| 273 6th Avenue, BK, NY | $1,600,000 | Coop Purchase |

| 1054 Mora Place, Woodmere, NY | $685,000 | House Refinance |

| 105 Park Place, BK, NY | $780,000 | Coop Purchase |

NYC Real Estate Buyers and Sellers Breathe Easier as L Train Shutdown Called Off

As reported by the New York Times, Governer Cuomo has called off a planned shutdown of the L subway track, which would have lasted 15 months. The shutdown, which was intended to repair structural damage caused by Hurricane Sandy in 2012, will be replaced by a program of gradual repairs, and will accommodate full weekday service with some partial weekend closures.

The cancellation of the long-awaited (and dreaded) track closure is a cause for cautious celebration in neighborhoods such as Greenpoint and Williamsburg in Brooklyn, which rely on the L train for convenient access to and from Manhattan. While the future of the track will be fully revealed in time, as work continues assess and repair the remaining structural damage, the new plan is likely to be a boon to those looking to buy or sell near the L train’s route.

Westchester NY Real Estate Attorneys Beware: Fair Housing Law Amended to Protect Co-Op Purchasers

In an effort to combat discriminatory practices by coop boards, Legislators in Westchester have amended the county’s Fair Housing Law (Article II of Chapter 700), effective immediately.

This new amendment attempts to close a loophole by which coop boards could potentially discriminate against prospective purchasers by delaying action on their application beyond a reasonable time frame, or by failing to notify an applicant if their application was incomplete, rather than rejecting them outright.

Upon receipt of an application, coop boards must now inform the applicant within fifteen days as to whether the application is complete or incomplete. If incomplete, the same time frame applies to the re-submitted application.

In addition, the board now must provide a written notice of acceptance or rejection to the applicant within sixty days after receipt of a completed application. If rejected, a copy of the notice must be sent to the Human Rights Commission no more than fifteen days after it has been sent to the applicant.

The new law, which has been decades in the making according to County Executive George Latimer, has not yet been taken up outside of Westchester County, though it is possible that such a measure may be discussed in the future. For more info, please see the full text of the law here.

The Top 5: What Bankers Love to See From Their NYC Real Estate Attorney

Our firm has represented a multitude of lenders in NYC real estate transactions over the years, working closely with loan officers and borrowers to see all parties to a smooth and successful closing.

While each lender works somewhat differently, our experience has given us significant insight into what bankers love to see from their attorneys. From conversations with the loan officers we represent, we have compiled a list of “best practices” below, which we hope will help bank attorneys provide the best level of service to their clients.

Without further ado, here are our top five tips!

- Proactive Weekly Updates:

No matter how many files are assigned to a specific bank attorney, it is helpful to the loan officer to provide an update once a week on the status of all of their open files. By providing this, the loan officer and bank attorney can ensure they are on the same page. Often, this will force further updates which help keep the rest of the team informed.

- Invitation to the Closing:

Many loan officers have expressed to us that they like receiving a calendar invite with the date, time, and location of the closing once it is scheduled. This way, they have the information readily available if they are traveling to the closing, or their client asks them to confirm it, or if they are simply having a hectic day.

- Aztech Package Delivery:

If a transaction is for a co-op, and the lender requires the bank attorney to draft and send the Aztech forms to the client, a quick email to let the loan officer know (as well as the buyer’s attorney if the transaction is a purchase) can go a long way to avoiding any potential delays. The address that the package was sent to and the tracking information should both be included. This way, everyone can make sure that the clients receive the forms, as unfortunately packages can sometimes be lost, stolen, or not delivered.

- Keeping Connected:

With so many people working together on a transaction, from loan officers to processors and underwriters to the bank attorney, it often happens that someone is not included on an important email. The bank attorney can help by being aware of this, and adding anyone who was excluded to the chain. It is best to keep the entire ‘team’ on every email—even if a particular email does not immediately pertain to everyone, it may hold information that is relevant to them later in the process.

- The Post-Closing Check-In:

Sometimes a loan officer is not able to be present at a closing. In these cases, we find that they appreciate an email afterward advising that the closing is complete, along well as any ‘color’ or ‘play by play’ as to what happened at the closing table. This information helps the loan officer prepare to follow up with their client afterward, particularly if any issues occurred during the signing process.

By now, you’ll have noticed that all of these tips share a common theme: communication! Being proactive and keeping your client updated at every point in the process is a tried and true way to provide the best possible service.

Did we miss anything in our list? Let us know! We’d love to hear your suggestions.

I Bought a Condo in NYC—Do I Need to Pay for my Recorded Deed?

This is one question that we hear frequently from our former clients, and the short answer is — no.

Once closing is complete, the title company is responsible for ensuring that the deed becomes public record by sending it to the county clerk for recording. Once the deed is recorded, the county clerk’s office generally mails the deed to the Purchaser’s attorney. Receipt of the original, recorded deed prompts our office to check the online records for further verification. We then send a copy of the deed to the client for free, as part of their final closing package.

New condo and house owners may receive official-looking letters advising them to pay for their original deeds. The letters offer to have the recorded deeds printed and sent to the new homeowners for a fee. These letters can look eerily like official government correspondence, but – as our savvy blog readers will know – they are not.

The important thing for NY condo and house owners to remember is that, even if they lose their copy of the deed, the deed is a public record. For New York City residents at least, recorded documents can be accessed any time for free through the Automated City Register Information System (ACRIS).

If you have further questions about how to access your deed, or about unusual correspondence received after closing, feel free to reach out to us.

GUEST BLOG: How Lenders and Banks Approve Coops and Condos for NYC Apartment Purchases

By Keith Furer, Guardhill Financial

Be a smarter investor by understanding how lender approvals on buildings work.

Whenever someone gets a mortgage on a unit within a coop or condo, a lender must not only approve the borrower, but separately approve the building. Like the borrower, a coop or condo must also meet certain requirements in order for a lender to place a mortgage on a building unit.

Specific lender requirements on buildings vary not only between lenders themselves, but also between condos and coops.

Examples of Lender Requirements on Coop and Condos:

– stable financial standing

– acceptable owner occupancy rates

– valid and up-to-date building insurance

– maximum commercial square footage

– absence of major litigation

But what’s actually involved in the approval process of a coop and condo by a lender?

Sometimes a lot, and sometimes very little.

To help demystify the process, the following are the main steps typically carried out by a mortgage professional like myself:

1. Check the Systems, Get Management Contact Info

My first step is to do a check of the building address in various online systems to see if the project has been approved or declined in the past by any lenders. Depending on how up-to-date the information is, that could determine whether it is wise to proceed with the purchase or not.

If a coop or condo shows up as approved with most lenders, including recently updated financial information, etc., that may be all the information that’s needed, depending on which lender will make the mortgage. However, this is rare, as there is usually at least one supporting document in need of updating.

The contact information of the building’s management is always required, regardless of whether it is professionally managed or self-managed. The real estate agent representing the property and your attorney will typically have this information. Most management companies today charge at least a nominal fee for coop and condo documents.

2. Getting & Submitting the Core Information

Assuming a coop or condo needs updated documents, my team will then contact the management entity to get the standard information, including two years financials, a building questionnaire, and underlying project insurance. These can offer a fairly complete picture of a building’s status, but sometimes other documents are required, like a recent budget and offering plan.

The financials show the overall financial health of a condo or coop, the budgeting, the reserves, etc. Two years are required so a building can demonstrate a more complete snapshot of its most recent results.

The coop or condo questionnaire contains all the basic information about the building, including everything from information on occupancy levels to initial sponsor information, to the underlying mortgage, and much more. The questionnaires typically run two to three pages.

Once we have the required documents, my team submits them to the applicable underwriting department along with the borrower documents. Quite often we are able to have the project approved or re-approved prior to the buyer signing the contract.

3. Proactive & Precision Follow-up Required

Whenever anyone gets a mortgage on any type of property, there are a lot of moving parts that have to be in place in a timely manner for that mortgage to close. My team and I move quickly across all the channels of the process, particularly when it comes to coop and condo approvals.

It is vital to be proactive with these approvals, because in some cases, they can drag out, and that can push back closing dates, which nobody likes or wants. Whether it’s coop or condo documents that are in the midst of being updated, or extended turnaround times for receiving documents, I’ve witnessed a lot of unforeseen delays.

In the cases when we come across any potential red flags for a coop or condo, like low occupancy rates or upcoming assessments, we communicate them with our clients and their attorneys and address each one head-on with the underwriters. Just because there’s a red flag doesn’t necessarily mean that there’s a problem, it just means there’s a matter to be resolved. The earlier red flags are identified and addressed, the smoother the whole process goes, and increases the likelihood of closing without delay.

Sometimes the coop and condo approval processes can be quick and sometimes they can drag on. Make sure you have the right team working for you to be proactive and help insure that you close on time.

Guest blog entries are for the benefit of the real estate community and do not necessarily reflect the views of this law firm.

Deadlines Within Deadlines: Cooperative Board Packages and Commitment Letters in NYC Real Estate Closings

A buyer (for purposes of this article, let’s call her Sally Streetwise) works with her broker to find a property she loves in a beautiful cooperative. The brokers work with the buyer and the seller to reach agreement on the key deal points and then turn the delicate deal over to the lawyers to conduct due diligence and to negotiate the more formal contract terms. After much back and forth between lawyers and clients, the contract is finalized, the buyer signs the contract and submits her deposit check, the seller’s attorney deposits the check to an escrow account, and the contract is fully executed.

You might think this would be a great point in time for the brokers, lawyers, buyers and sellers to take a collective sigh of relief, pat themselves on the backs, and look forward to a smooth closing. Alas, there is no rest for the weary in Manhattan real estate. With the finalization of the contract comes something lawyers and brokers deal with every day of their careers, but something first-time buyers like Sally Streetwise may not yet be fully prepared: DEADLINES, and the pitfalls for missing them.

The New York residential real estate contract will not satisfy itself with simply one deadline. There must be multiple deadlines, as many deadlines as there are subway lines (or double-parked cars) in Manhattan: Deadlines to apply for mortgages. Deadlines to obtain Commitment Letters. Deadlines to submit board packages. Deadlines for providing notices. Deadlines to schedule closings. Deadlines to adjourn closings. Deadlines that increase stress and confuse everyone throughout the process. While some lawyers, bankers, and brokers push forward as quickly as possible hoping that they avoid any deadline land mines, experienced practitioners will help the buyer navigate deadlines to lessen their stress and protect their best interests.

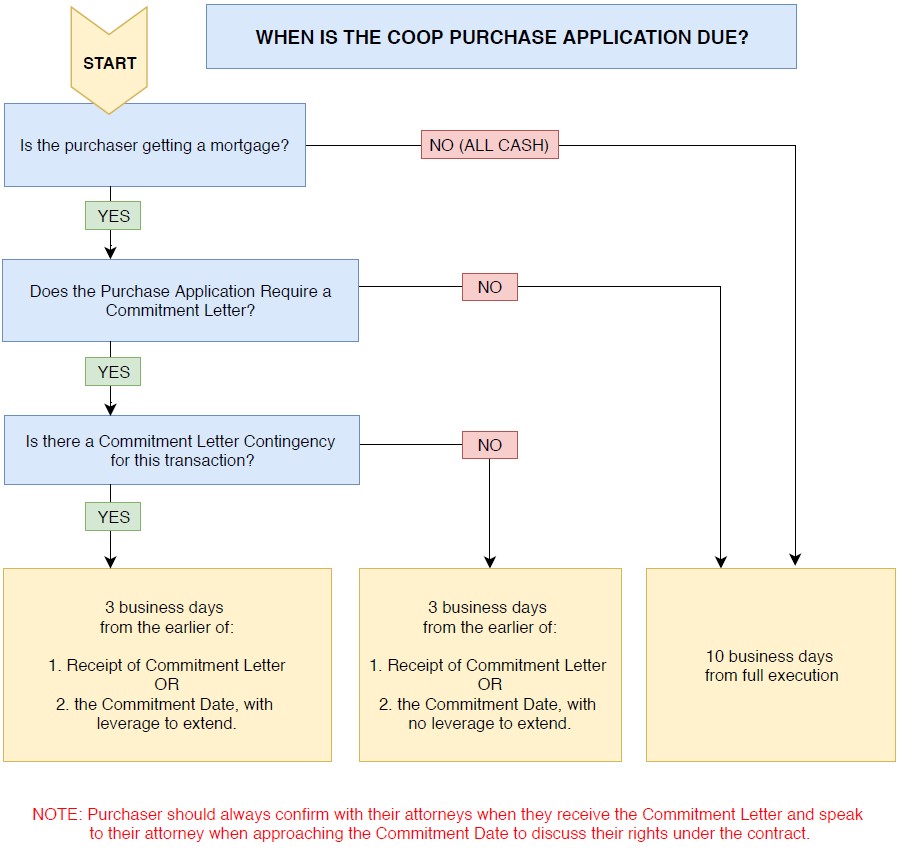

Let’s spend a few minutes to get acquainted with two of the most significant deadlines our buyer will encounter once she gets into contract: the board package submission deadline and the loan Commitment Letter deadline (“Commitment Date”). In the typical contract for the purchase of a cooperative unit, the answer is clear: Sally Streetwise has ten business days to submit her board package. Unless she has three business days. But remember that the three-business-day deadline begins to run at the expiration of a completely different thirty or forty-five-calendar-day Commitment Date. Sometimes. Or it begins to run sooner.

Let’s break that down a little bit further to clear up this confusion. One commonly used contract contains multiple deadlines for the submission of the board package, depending on different circumstances that might exist:

If Sally Streetwise is not seeking financing, and is proceeding “all cash,” she will need to submit her board package within ten business days of her attorney’s receipt of a fully executed contract (unless otherwise negotiated).

If Sally is seeking financing, then the determining factor for the board package deadline will be whether a commitment letter is required to be submitted with her board package. If the board does not require a commitment letter as part of the board package, then the original ten-business-day deadline is still in effect. However, most boards do require a commitment letter because most boards reasonably believe that if a buyer is unable to obtain a commitment letter, the deal will not go forward. There would be no point wasting time reviewing such an application.

If the board requires a commitment letter as part of the board package, then it’s important to note that the contract will include the Commitment Date of usually thirty or forty-five days from the date Sally’s attorney receives a fully executed contract. Sally’s board package deadline also then hinges on whether her contract has a Commitment Letter contingency.

If Sally’s contract has a Commitment Letter contingency, then her deadline is three business days from the earlier of when she receives the Commitment Letter or the Commitment Date.

If, on the other hand, Sally is seeking financing but her transaction does not include a Commitment Letter contingency, then Sally’s deadline is three business days from the earlier of: (1) when she receives the Commitment Letter or (2) the Commitment Date, with one important caveat: even if Sally has not obtained a Commitment Letter by the Commitment Date, she must still submit her board package within three business days from the Commitment Date.

Given the complexity described above, we would always recommend that a potential buyer, with the assistance of her broker, obtain a copy of the board application before entering into the contract for the purchase of the cooperative unit. This way they will know ahead of time whether the board requires the commitment letter as part of the board package and thus the deadline to submit that package. The broker and the buyer should work together to get the board package as complete as possible so that the only open item remaining while approaching the Commitment Date will be the lender’s issuance of a Commitment Letter.

One common pitfall to note: we all come across deadlines in our daily lives. When facing a deadline, there’s often an impulse to hurry up and beat the deadline by as many days as you can. In the context of the Commitment Date described above, and board package deadline, however, this is not necessarily the best path forward.

Once parties are in contract, Sally Streetwise should start working on her loan with her banker and on the board package with her broker. The goal for both is not necessarily to beat the deadlines to a pulp, but rather to meet the deadlines with the best work product possible within the time permitted.

For bankers working on the commitment letter, a number of open conditions may initially exist on the commitment letter and the banker should work with the client to try to eliminate as many open conditions as possible prior to the Commitment Date. For example, if a banker states that Sally Streetwise’s parents must provide a “gift letter” for funds that were given to her to purchase her first home, it would be best to obtain the gift letter and have that condition cleared from the commitment letter, rather than having the commitment letter issued with the open condition. What if Sally’s parents refuse to sign a “gift letter” for the funds they provided her? These types of potential issues would be better discovered while in the contingency period rather than after the contingency has lapsed.

It is also critical to have an experienced banker who is familiar with the interplay of the Commitment Date and the board package timeframes. Less experienced bankers may issue a commitment letter quickly in an apparent effort to impress the borrower, but inadvertently trigger the 3-day deadline described above when the borrower is not yet ready to submit the board package.

With respect to the board package, Sally Streetwise will want to have an open dialogue with both her banker and her broker, so that they take the time to prepare a board package that shows Sally in the best light and is most likely to result in board approval. Sometimes this means waiting until the most recent bank statements are available from the buyer’s bank, or waiting until the perfect source of a professional reference is back from vacation.

There is one notable exception to the above. What should Sally do when she obtains a commitment letter that is still subject to a satisfactory appraisal, but the appraisal has not yet been conducted or approved by the bank? In such a case, the typical real estate contract states that a commitment letter subject to an appraisal is not a “Commitment Letter” as defined in the contract unless and until the appraisal condition is satisfied. The first goal would be to make sure the appraisal is satisfied before sending the Commitment Letter as part of the board package. However, there are times that the broker will want to submit the board package quickly, for example to make the next board meeting deadline, and so they would prefer to submit the commitment letter with the appraisal condition. In such a case, the buyer may decide to submit the commitment letter even though it is still subject to an appraisal, but the buyer should state that it is a preliminary commitment letter with their right to cancel still intact under the standard commitment letter contingency clause.

One final note on deadline extensions: buyers should take note that in the world of contract law, there is a difference between a deadline where a buyer is given a right of action and a deadline where a buyer has no such right. For example, take the case where a buyer with a finance contingency has done her best to cooperate with the bank to obtain a commitment letter, but through no fault of her own, the bank is unable to issue the commitment letter prior to the typical thirty-day deadline. In such a case, the buyer would potentially have the right to cancel the contract. Given that right, there is a possibility that a buyer could request from the seller an extension of that deadline rather exercising the right of cancellation. This wielding of the implied power to cancel often results in the seller granting an extension.

Contrast this situation with the deadline to submit a board package. Here, in the normal circumstance, the buyer does not have a right to cancel if the board package is not submitted on time, and therefore may not be successful in seeking an extension of such a time. Seeking an extension in such a circumstance comes with risk. If the seller does not agree (and there is no requirement that they do) then the buyer must rush to submit the board package or risk being held in breach of the contract, which potentially subjects the buyer to the loss of the deposit. If a broker or client is concerned with the board package submission deadline, the most effective time to address this concern is during the contract negotiation stage, when additional time can be added to the contract.

Due to the complex interplay of deadlines described herein, it is imperative that a buyer work with seasoned professionals when selecting a lawyer, broker, and banker. Each of these professionals works with the others to ensure that the deadlines are effectively met and with information that puts the buyer in the best possible position to succeed in the transaction.

PLEASE NOTE: This article is intended for informational purposes only and does not constitute the dissemination of legal advice. The deadlines and some of the legal language discussed herein is subject to negotiation between the parties involved and/or interpretation by a court of law. We encourage you to speak with the attorney handling your specific transaction for further details.